28+ Home pre approval calculator

The 2836 rule is a good starting point to. Compare personal loans from online lenders like SoFi Marcus and LendingClub.

904 County Road 2600 Lometa Tx 76853

I continue to be immensely proud of how the Merck team is performing in all facets of our business scientifically commercially and operationally said Robert.

. Multiply your gross monthly income by 28. Your Guide To 2015 US. Time to Shop for your New Home.

A mortgage pre-qualification can be useful as an estimate of how much someone can afford to spend on a home but a pre-approval is much more valuable. Likewise if you exceed the 60 to 90 day time-frame it will no longer be valid. Majority of sellers also request for a pre-approval letter before closing a deal.

How much house can I afford. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Let Domain Home Loans simplify the loan submission process for you.

Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Assuming you have a 20 down payment 60000 your total mortgage on a 300000 home would be 240000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1078 monthly payment.

Things to consider. When owning a home you pay annual property taxes based on the assessed value of the property or purchase price of the home which can affect your affordability. Homeowner Tax Deductions.

Pre-qualify for your personal loan today. This pre qualification calculator estimates the minimum required income for a house will let you know how much housing you qualify for a given income level. Median incomes have not kept pace with home price increases which has slowed the pace of home purchases.

If youre serious about buying a home you need to get pre-approved for a mortgage. See how much home you can afford with Guaranteed Rates easy-to-use home affordability calculator. Domain Home Loans helps you get the right Home Loan at a great rate.

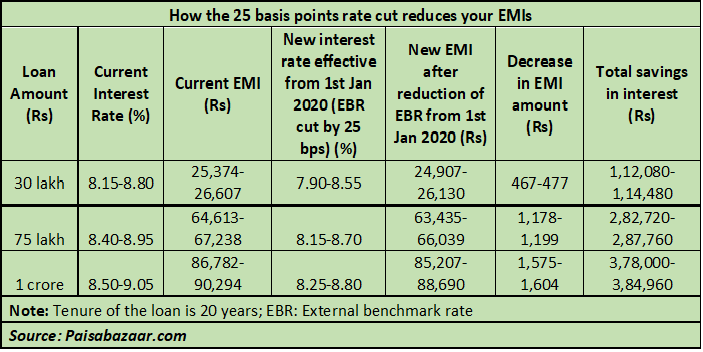

A rate cut of 025 on a R1 million home loan can save you almost R40 000 over 20 years. To calculate this multiply your monthly income by 28 or 36 and then divide it by 100. Service New Vehicles Pre-Owned Vehicles Search.

This in turn caused 2020 to be a record year for home loan origination volume with roughly 27 trillion of 41 trillion in mortgage volume being refinance loans. Work with your lender of choice to be pre-qualified for a mortgage loan. Renting a home I want to rent.

Why you should get pre-approved oobas pre-approval allows you to check your credit score and assess how much you can afford. Housing and finance tips. Choose from over 25 lenders.

Annual Percentage Rate APR programs rates fees closing costs terms and conditions are subject to change without notice and may vary depending upon credit history and transaction specifics. Fannie Mae HomePath. Multiply your annual income by 028 then divide that total by 12 for your maximum monthly mortgage payment.

The company announced Q2 worldwide sales of 146 billion an increase of 28 from Q2 2021. You must go through the pre-approval process all over again. The College Graduate Reward Program and College Graduate Finance Program are available upon credit approval from and execution of a finance or lease contract through a participating Lexus dealer and Lexus.

Rates start as low as 5 for qualified borrowers. Use this FICO Loan Savings Calculator to double-check scores and rates Note that on a 250000 loan an. Most lenders and calculators evaluate affordability with the 2836 rule which establishes that your housing expenses and total debt should not be more than 28 and 36 of your total pre-tax income respectively.

DealerRater Aug 28 2022. Plan and manage your mortgage. Housing options for Seniors.

The 36 part is that you shouldnt spend more than 36 of your income on monthly debt payments including your mortgage credit cards and other loans such as auto and student loans. Our calculator assumes a property tax rate by default but you can edit this amount in the calculators advanced options. Are you wondering if you qualify for a home loan.

Schedule Service New. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your. Many new homeowners are surprised to learn the true cost of owning a home.

All loan applications are subject to credit and property approval and must meet loan program requirements to qualify. View approval of the Ladder Safety Training Course. This home affordability calculator provides a simple answer to the question How much house can I afford.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment. How much home you can afford depends on a few factors. InterNACHI has a state-approved pre-licensing course and a state exam available.

InterNACHI provides everything you need to become a successful home inspector in Florida. The tax rate you pay can vary by state county and municipality. We simplify your answer.

Now that you are pre-qualified and know what price range to consider for your new home we recommend you work with a licensed Texas Realtor to guide you with finding your home in the community you want and negotiate all the many steps. Get free access to training classes logo design and more. Most homebuyers who obtain pre-approval are serious about buying a house within the said time.

Heres a rule of thumb to help you get a sense of what kind of home you can afford. But like any estimate its based on some rounded numbers and rules of thumb. Mortgage financing options for people 55 Preventing fraud and financial abuse.

Manage your mortgage Mortgage fraud. The 28 part of the rule is that you shouldnt spend more than 28 of your pre-tax monthly income on home-related expenses. Higher ratios also.

Minimum FHA Credit Score Requirement Falls 60 Points October 11 2018. The result is the maximum you should spend on your monthly payment for housing mortgage principal interest taxes and insurance. The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt.

Using a percentage of your income can help determine how much house you can affordFor example the 2836 rule may help you decide how much to spend on a home.

Ford S Colony In Williamsburg Va New Homes By Ford S Colony Realty

Sbi Home Loan Interest Calculator Outlet 57 Off Www Ingeniovirtual Com

Getting Pre Approval For A Mortgage Is An Important First Step In Buying A House Learn What You Need Preapproved Mortgage Buying Your First Home Home Mortgage

Homebuyer Tips When Applying For A Mortgage Mortgage Loans Mortgage Process Refinance Mortgage

How Much House Can I Afford Buying First Home Home Mortgage Mortgage Marketing

What Is A Mortgage Preapproval Ally Preapproval Mortgage Infographic Mortgage

Sbi Home Loan Interest Calculator Shop 52 Off Www Ingeniovirtual Com

Sbi Home Loan Calculator 2019 Sale 58 Off Ilikepinga Com

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Kinglet Plan At Cross Creek Ranch 45 In Fulshear Tx By Tri Pointe Homes

Sbi Personal Loan Interest Rate Calculator Flash Sales 55 Off Www Ingeniovirtual Com

311 Mussey Road Johnstown Ny 12095 Mls Id 202225051 Coldwell Banker Prime Properties

Sbi Home Loan Calculator 2019 Outlet 59 Off Www Ingeniovirtual Com

Sbi Home Loan Interest Calculator Outlet 57 Off Www Ingeniovirtual Com

14 Best Ways To Save For A House Hanfincal Com

Sbi Home Loan Calculator 2019 Outlet 59 Off Www Ingeniovirtual Com